PEO or ASO?

| PEO | ASO | |

|---|---|---|

| Employee Benefits | ||

| Worker's Compensation Claims | ||

| Payroll | ||

| Payroll Tax Compliance | ||

| Unemployment Insurance Claims | ||

| Co-employs Client Employees |

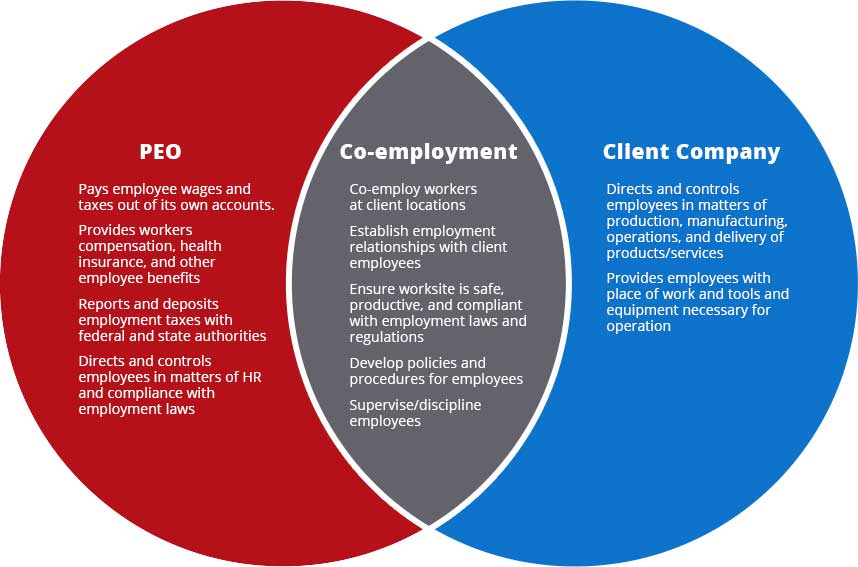

Both PEOs and ASOs provide HR, payroll, and administrative services for their clients. The main difference between ASOs and PEOs is the question of co-employment. PEOs become a co-employer of their client company's employees and assume some of the liabilities and responsibilities that come with employing personnel; ASOs do not become a co-employer and file all tax and insurance forms under their client's company name. Both services are beneficial to companies.

Contact us to find out which service agreement best suits your company's needs.

PROFESSIONAL EMPLOYMENT ORGANIZATION

PROFESSIONAL EMPLOYMENT ORGANIZATION

Who uses PEOs?

PEOs provide the HR infrastructure small businesses need. They also offer better employee benefit packages to small- to mid-sized businesses because they can buy in bulk. They group your company employees with employees of their other clients and get the discounts and perks that only large companies usually have access to.

How does a PEO work?

The PEO becomes a co-employer of your employees. The PEO does all your administrative HR work such as employee benefits, payroll, risk management, and employee tax compliance—allowing you to focus on operating and growing your business. PEO co-employer responsibilities are mostly administrative and cover these areas:

- Employee benefits

- Worker's compensation claims

- Payroll

- Payroll tax compliance

- Unemployment insurance claims

Here are a few details on how the PEO/client relationship looks, and how the co-employment agreement affects your employees:

- Your employees continue to work at your company locations(s).

- The PEO pays your employees' wages and taxes out of its own accounts

- The PEO collects, deposits, and reports your employees' employment taxes with the proper state and federal authorities.

In many cases, PEOs build a long-term relationship with client employees—often to ensure your company complies with any pertinent regulations—and to manage the liability they assume as a co-employer of your employees.

ADMINISTRATIVE SERVICES ORGANIZATION

ADMINISTRATIVE SERVICES ORGANIZATION

Who uses ASOs?

ASOs are a great solution for small- to mid-sized companies. They are expert at taking care of the legal and administrative requirements of running a business—allowing you to focus on generating revenue and building your business.

ASOs allow you to offer your employees better and more competitive benefits because they can group large numbers of workforce employees. This way, they get the discounts and perks that only large companies usually have access to.

How does an ASO work?

The ASO performs all the administrative HR tasks for your company and ensures you are in compliance with employment regulations. They provide the following services:

- Employee benefits

- Worker's compensation claims

- Payroll

- Payroll tax compliance

- Unemployment insurance claims